Ethical investments

Plantation forestry with nature conservation and livelihood improvement

Executive summary

ArBolivia Project summary

- Plantation forestry with smallholders on part of their land in the foothills of the Bolivian Andes. Farmers retain ownership of their land.

- Variety of valuable, predominantly indigenous, timber species. Growth cycles up to 35 years.

- At least 20% of land planted with trees set aside for permanent nature conservation.

- Livelihood improvement for participating farmers by means of:

- direct payment for labour

- fair trade timber prices

- microcredits, with trees as collateral

- land-use plan for whole property of the participating smallholders

- assistance with improving agriculture techniques.

- Deal with land owners: help with financing and capacity building in exchange for setting aside % of land for permanent ecological protection.

- Additional logistic costs are more than compensated by selling Carbon Credits (VERs) and Tree Planting Subsidy Certificates (TPSCs). These financing sources may cover a significant part of the investments needed until break even, providing an attractive rate of return for equity investors. Bank loans may provide further leverage.

- Net timber revenues split equally between smallholders and investors.

- The project formula is financially very attractive for investors and at the same time it produces lasting ecological and social added value. ArBolivia is highly green and social and financially profitable at the same time.

Project target in numbers

- 5,000 hectares commercial forest plantations.

- 1,000 hectares agroforestry.

- 1,200 hectares conservation of primary and secondary forests involving repair and conservation of ecological structures (contractually linked with the commercial planting program).

- Around 2,000 smallholders to be contracted.

- USD 466 million total gross timber revenues.

- USD 142 million net revenues for all investors and supervisory management (= 50%)

- USD 142 million net revenues for smallholders (= 50%) .

- Investors together receive 47% of the net revenues.

- Supervisory management receives 3% of the net revenues.

Already realized

- The project has been running for more than four years.

- 1,000 smallholders contracted.

- 1,500 hectares planted.

- Project (5000 ha) certified by Dutch Government as a Green Project.

- All project activities monitored and registered in a well developed database. The database is accessible through the internet.

- High level of traceability of project products such as VERs and TPSCs.

- USD 5.1 Million already invested by Sicirec and other investors.

- Listing on NPEX (Dutch Participation Exchange) market possible for 2012.

Summary financials (realistic scenario)

- USD 14.7 Million total project costs until break even in period 2015/2016.

- USD 5.1 Million already invested.

- USD 0.6 Million to be re-financed.

- USD 10.2 Million still to be covered before break even

Equity investors receive a share in the net revenues based on their total commitment until break even, rather than what they actually invest.

The more project financing is covered by VER and TPSC sales etc., the less equity is needed. This is the main driver for the profitability for equity investors, because the profit-sharing percentage based on the total commitment remains constant.

Equity still required

The project is looking for an investor (or investors) who will commit to the further project financing until break even (2015/2016) to the amount of approximately USD 7,000,000. This also includes the amount to be covered by bank loans and by VER, TPSC and other environmental services sales. The amount actually to be invested is USD 7 M minus those other sources of income (see “Summary financials” above).

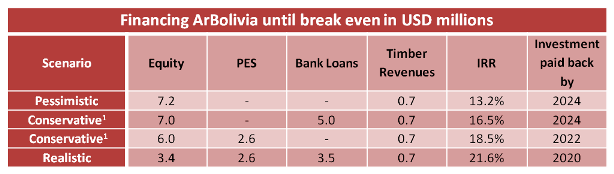

In the table below there are two rows with “conservative” scenarios. One with bank loans but without PES revenues and one with PES revenues and without bank loans. These are to demonstrate the effect of bank loans and PES revenues on the IRR.

The “Realistic” row represents the scenario in which both bank loans and PES revenues are utilised.

The numbers in the scenarios given are based on a 60% share in the timber revenues for the investor(s).

It is conceivable that the sales of VERs and TPSCs may in fact provide all the finance needed until break even. In that case the actual investment by the equity investor(s) at or before break even could be reduced to zero. This creates a significant “upside” potential for the investor(s).

Required equity in different scenarios

In the conservative scenarios the investment will have been paid back by 2024 or 2022, whereas in the realistic scenario the investment will have been paid back by 2020.

The full USD 7.0 million can be reduced once revenues from VERs and TPSCs and/or bank loans have been realised.

In the above comparison the same best timber revenue estimates have been used in each scenario. This is because the major driver for the IRRs to be expected is in the structure of the financing in the early years; very different amounts of equity resulting in roughly the same revenues.

Additional investor rights

- 100% full transparency.

- A position on the board of Sicirec Bolivia (optional).

Rights for providing part of the project finance

For a commitment of part of the project finance still required, the investor will receive a proportional fixed part of the revenues as described above.